Property Tax Nevada

Nevada Property Taxes By County - 2022 - Tax-Rates.org

The median property tax in Nevada is $1,749.00 per year for a home worth the median value of $207,600.00. Counties in Nevada collect an average of 0.84% of a property's assesed fair market value as property tax per year. Nevada is ranked number twenty four out of the fifty states, in order of the average amount of property taxes collected.

https://www.tax-rates.org/nevada/property-tax

Real Property Tax Information - Clark County, Nevada

The property may be redeemed by payment of taxes and accruing taxes, penalties and cost, together with interest on the taxes at the rate of 10 percent per annum from the original date due until paid. Property owners have two years from the date of the certificate to redeem the property by paying the property taxes and all associated costs in full.

https://www.clarkcountynv.gov/government/elected_officials/county_treasurer/real_property_tax_information.php

General Property Tax Information and Links to County Assessors ... - Nevada

Property Tax Rates for Nevada Local Governments (Redbook) NRS 361.0445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. You may find this information in “Property Tax Rates for Nevada Local Governments” commonly called the “Redbook.”

https://tax.nv.gov/LocalGovt/County_Property_Tax/General_Property_Tax_Information_and_Links_to_County_Assessors_and_Treasurers/

Property Tax | Nevada County, CA

Nevada City, CA 95959. Phone: 530-265-1218. E-mail Webmaster. Quick Links. Appointed Officials; Board of Supervisors; County Executive Office; Elected Officials; ... The Auditor-Controller Property Tax Division is responsible for the calculation and preparation of the secured, unsecured, unitary and supplemental property tax bills; maintaining ...

https://nevadacountyca.gov/210/Property-Tax

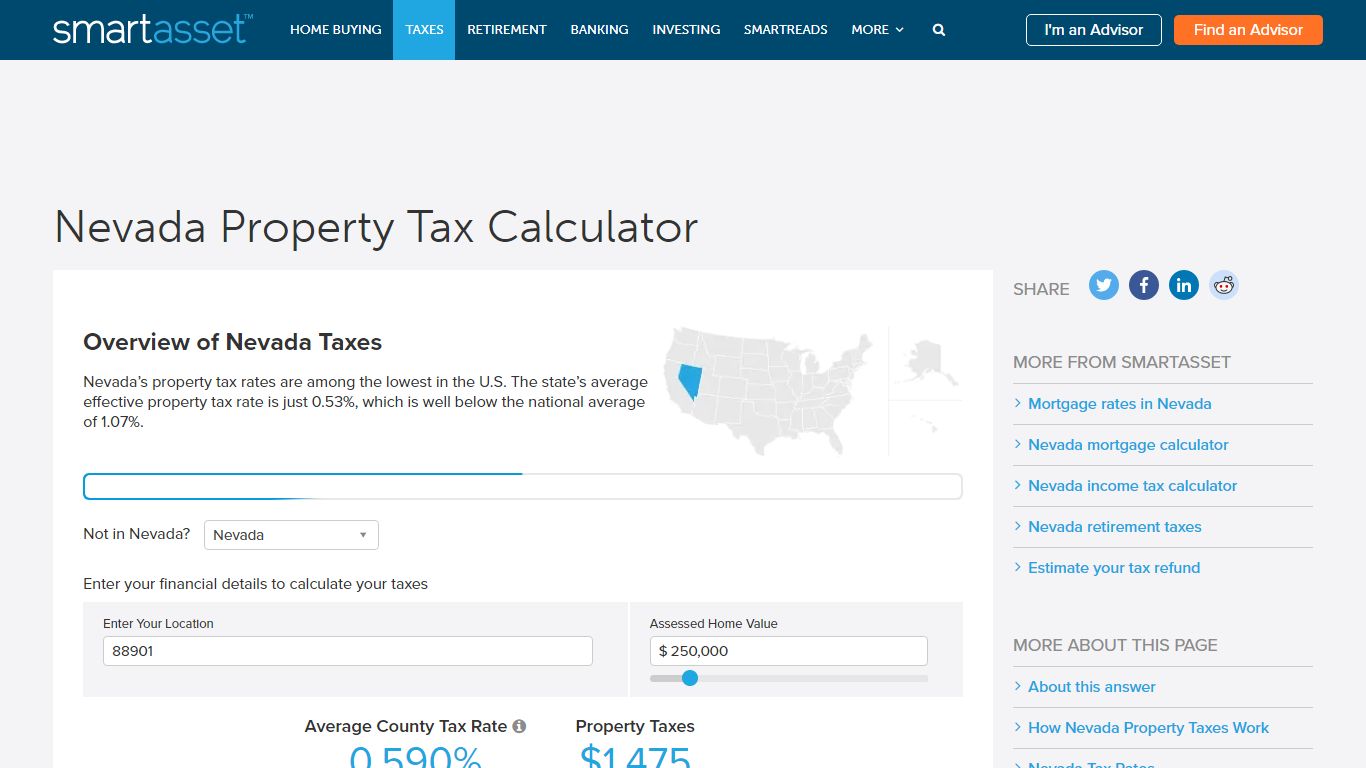

Nevada Property Tax Calculator - SmartAsset

The state’s average effective property tax rate is just 0.53%. Compared to the 1.07% national average, that rate is quite low. Homeowners in Nevada are protected from steep increases in property tax bills by Nevada’s property tax abatement law, which limits annual increases in property tax bills to a maximum of 3% for homeowners.

https://smartasset.com/taxes/nevada-property-tax-calculator

Property Tax Bills | Nevada County, CA

Call (877) 445-5617 to pay over the phone with a credit card, debit card, or E-Check. There is a 2.38% convenience fee on all credit and debit card payments. E-Check payments are free of charge. Phone payments made up until 11:59 pm PST on December 10th and April 10th will be considered timely. Pay in Office

https://www.nevadacountyca.gov/372/Property-Tax-Bills

Pay Property Taxes Online | Clark County Official Site

The Clark County Treasurer provides an online payment portal for you to pay your property taxes. Please visit this page for more information.

https://www.clarkcountynv.gov/pay/property_taxes.php

Nevada homeowners may be paying more on property taxes - KTNV

LAS VEGAS (KTNV) — You could be paying more on your property tax than you realize. Under state law as a property owner, you can apply for a three percent tax cap on your primary residence. However,...

https://www.ktnv.com/news/nevada-homeowners-may-be-paying-more-on-property-taxes

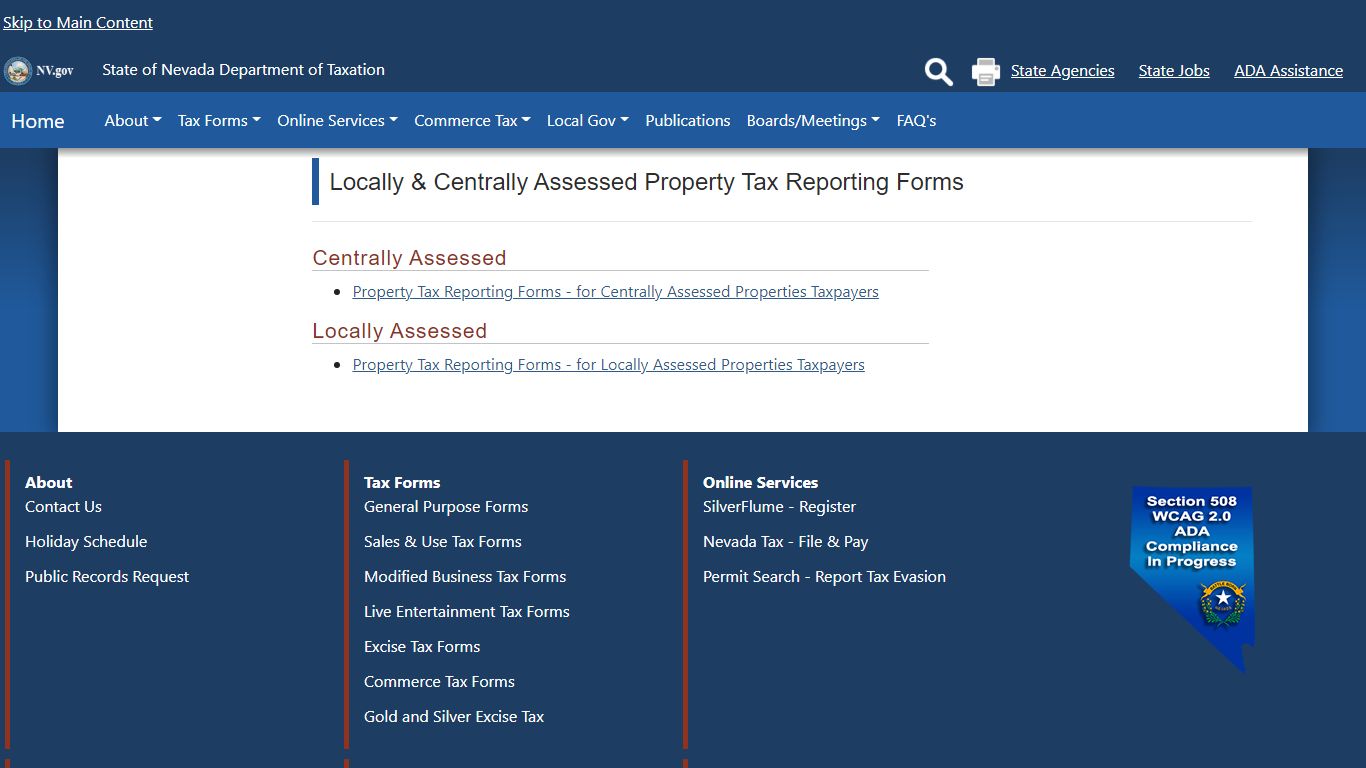

Property Tax Reporting Forms - Nevada

Locally Assessed. Property Tax Reporting Forms - for Locally Assessed Properties Taxpayers. About. Contact Us Holiday Schedule Public Records Request. Tax Forms. General Purpose Forms Sales & Use Tax Forms Modified Business Tax Forms Live Entertainment Tax Forms Excise Tax Forms Commerce Tax Forms Gold and Silver Excise Tax. Online Services.

https://tax.nv.gov/LocalGovt/CA_Prop/Property_Tax_Reporting_Forms/

Property Taxes - Douglas County, Nevada

Fiscal Year 2021-22 Property Taxes – 4th Installment Due 02/25/2022 NOTICE TO TAXPAYERS OF DOUGLAS COUNTY, NEVADA The fourth installment of the 2021-2022 property tax is due and payable on March 7, 2022.

https://cltr.douglasnv.us/online-payments/property-taxes/